Among the entourage of government officials and prominent business leaders who accompanied Prime Minister Stephen Harper on an early-August trade mission to Brazil was the chief executive officer of a relatively obscure Canadian company called Weatherhaven.

Established in 1981, Weatherhaven outfits militaries, relief organizations, exploration firms, peacekeeping operations and others with portable and reusable shelters for places and situations that most people would rather avoid in the first place. Eighty percent of the base camps in Antarctica rely on their products, and increasingly, the shelters are finding their way into the humid and sweltering recesses of Brazil’s Amazonian basin.

To operate in one of the most exciting growth markets on the planet, the company had to grapple with Brazil’s strict regulatory apparatus and leap over a menacing tariff wall that keeps out foreign-made products and workers. “The attitude down there is: there is so much opportunity in Brazil that, even though there is a cost of doing business here, the size of the pie and the reward is sufficiently large that it’s worth paying that cost,” says Ray Castelli, CEO of Weatherhaven. After 10 years of activity, they’ve only begun to penetrate the markets of the world’s seventh-largest economy.

Weatherhaven’s shelters, some of which resemble large greenhouses, are actually sophisticated structures that come equipped with generators, water treatment systems and even creature comforts like plasma screen televisions. They can be set up in minutes with basic tools and last up to 20 years.

In the early days, the company’s products were used mainly by mining and exploration firms in Canada’s north, offering workers respite from extreme temperatures and conditions. The initial feedback from frozen workers was great. The arched-roof shelters offered much more warmth and were much sturdier than Weatherhaven’s predecessors: canvas tents and wooden shacks. According to a 2009 story in The Province, workers at an Arctic mining exploration site returned one June after a winter of severe winds to discover the only things left standing among the debris of what once were permanent wooden structures were Weatherhaven shelters.

Today, more than 200 members of the Canadian Forces in Kandahar find refuge from Afghanistan’s wild temperature swings in their shelters, which are meant to withstand a temperature range between 50°C to -50°C. Japan had a stockpile of them when the devastating earthquake and tsunami struck last March, and Weatherhaven participated in the Haitian earthquake relief effort by selling relief agencies 140 temporary shelters at cost.

Moving into Brazil was a natural progression for Weatherhaven, Castelli says, who describes the country’s physical and economic characteristics positively as a “perfect storm.” Brazil’s robust economy, with a heavy reliance on natural resources, is fuelling rapid growth and funding widescale infrastructure projects in remote regions. Add in the government’s push for environmental sustainability, which restricted logging and therefore materials for wood shelters, and Weatherhaven found a near-perfect market. But it would be a long time before Castelli could kick back and enjoy an ice-cold caipirinha. “You can’t simply just set up shop at the border and say, ‘Here’s something I want to do,” says Castelli, an experienced business executive who speaks four different languages and has spent 12 years doing international business development for a number of firms, including Alcan.

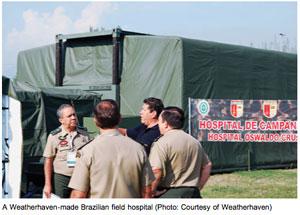

Weatherhaven’s venture into Brazil began humbly over a decade ago when the company began supplying the Brazilian military with shelters to be used as field hospitals. Later, deals were inked with mining behemoth Vale, which hadn’t yet gobbled Inco and had a market capitalization of less than 2% of its present value. But just getting to that point where they could sell in Brazil had proven to be a big challenge.

Brazil’s history over the past century is intertwined with military dictatorship and populist governments with strong protectionist tendencies, including outdated economic ideologies that its leaders embraced for decades after the Second World War. In the 1930s, governments introduced a vast collection of labour laws to assuage the grievances of a burgeoning working class, and Castelli says the laws have become ingrained in the commercial ethos of the nation. “The country’s regulatory framework is built around the protection of its workers and its people,” he says. It took many years to convince government bureaucrats to remove a regulation that effectively barred the company’s products from the Brazilian market. What seemed like a simple issue to Weatherhaven turned out to be a Byzantine struggle with Brazilian bureaucracy. The issue? Ceiling height. The Weatherhaven shelter’s arched ceiling was a structural feature that ran up against a rule that required workers’ camps to be composed of buildings with straight walls and a uniform minimum ceiling height of seven feet.

Weatherhaven officials began making presentations to labour departments, followed by product testing and demonstrations. Even the Brazilian minister of labour popped by to perform an inspection, and surveys were conducted with employees to gauge their opinions. With positive reviews, the breathable shelters with a translucent fabric roof, perfect for the suffocating humidity of the Amazon, won approval, and Weatherhaven finally began selling.

By 2006, the company was running a growing operation in a handful of nations across the globe, and revenues approached $20 million. But international expansion created the need to develop a strategy that would contain manufacturing and shipping costs to maintain competitiveness. The company needed to move its production operations closer to the countries where its shelters were needed. For Brazil, part of the earlier agreement to get Weatherhaven’s products market-approved included an agreement to transfer its technology and begin using Brazilian labour. “It’s a very complex place to operate,” Castelli says. “Any company that’s thinking about moving down there to do business…has to take a really serious look at the cost of doing business and try to find local people and local partners.”

Finding domestic talent was imperative to establish administrative offices and production facilities in the country. The company hired a Brazilian national as the managing director for its fledging operations, and within four years, Weatherhaven Brazil was born.

According to the United Nations, Brazil received US$48.4 billion in foreign direct investment (FDI) in 2010, an increase of 84.6% from the year before. Today, Brazil sits at No. 5 in a 2010 UN ranking of countries receiving FDI, and early numbers from the Central Bank of Brazil put the economy on pace to eclipse the previous year with US$43 billion in FDI for the first six months of 2011.

Symptomatic of the rapid growth experienced by the other BRIC nations (Brazil, Russia, India, China), Castelli sees the country slowly shedding its old ways and embracing reforms, but many challenges still lie ahead. “I see Brazil in a transitional phase right now, where it still has vestiges of this old protective state regulatory framework,” he says.

One area of needed reform Castelli highlights is the Brazilian labour code, a monolithic compilation of 900 articles, backed up by powerful labour courts that cost the state more than $6 billion to operate. The Economist has called the comprehensive legislation archaic, and says it indiscriminately penalizes businesses as well as workers. “Certain things are very hard to change, especially the labour laws,” says Andre Nudelman, chairman of the Canadian Council for the Americas in British Columbia. He says President Dilma Rousseff, a member of Brazil’s Workers’ Party, has little political will to make changes that could create divisions within her party. Taxation is also an area that poses challenges, Nudelman says. Like Canada’s provinces, each Brazilian state has its own distinct rates, and taxes are also filed monthly, creating unique situations when a fiscal year is stacked with monthly losses apart from a few profitable months. In that scenario, even if the firm finishes the year in the red, it would still be required to pay income tax based on the profitable months. And unlike in Canada, Nudelman says only 30% of a firm’s losses can be carried forward from year to year.

Another area is the cost of labour. “Much of the burden of looking after the employee from a social benefits perspective is passed on to the employer,” Castelli says. For starters, Brazilian workers are entitled to the type of vacation benefits that make Canadians envious: one month of paid relaxation. And depending on the employee, companies may be obligated to provide meal vouchers and subsidize transportation costs. Salaries are relatively low, he says, but slowly catching up to those of other developed countries. Corruption is another concern. In August, authorities arrested the deputy tourism minister for pocketing public money, and President Rousseff was forced to remove her transportation minister over claims of wrongdoing. Nudelman says that corruption concerns have played a factor in the decision-making process for firms looking to enter Brazil in the past, but acknowledges that things are getting better.

For the future, a big positive for Weatherhaven and Brazil is stability. “Nothing indicates that there will be retrogression, both in the democratic system and in the conduct of the Brazilian economy, toward a broad participation and integration with the rest of the world,” says Solival Menezes, a former economics professor at the University of São Paulo, who now operates a business consultancy in Canada. With a trade relationship with Canada worth nearly $6 billion in 2010 and growing, things are certainly moving along well for the two nations, especially after a hostile trade dispute in 2002 between aerospace firms Bombardier Inc. and Brazil’s Embraer SA over dual accusations of receiving government subsidies. Canadian firms increasingly appear to be cashing in on Brazil, as well. Estimates suggest 400 Canadian companies are operating there, and exports of Canadian merchandise increased by 60% from 2009 to $2.6 billion last year. Castelli also speaks positively of government efforts to increase trade. These efforts are bearing fruit for Weatherhaven, which recently partnered with Brazilian construction and logistics company Esbracon, to provide up to 10 sustainable camp projects for oil and gas exploration giant, HRT of Brazil. The deal came soon after the prime minister’s visit to South America.

Over the past four years of Weatherhaven’s Brazilian efforts, the company’s revenues have quadrupled, and 2011’s forecast is projecting sales of close to $100 million. Castelli expects Brazilian operations to continue to help drive his company’s growth. “There is tremendous opportunity down there. There are so many potential infrastructure projects,” he says.

Looking ahead, Castelli says the company’s diverse sales mix will provide a natural hedge to an increasingly volatile global economy. Militaries are cutting costs, but demand still exists while nations deploy forces in remote regions for tactical operations. Disaster relief will always provide revenue, and Castelli thinks high global demand for commodities will continue to push mining and exploration companies into remote areas where Weatherhaven’s shelters are made to perform. As long as there’s bad weather, they’re counting on good business.